Who is an investor?

Most people think an investor is someone who invests in stocks or real estate.

Neahh….. That’s too short-sighted.

You should think of an investor as a master at capital allocation.

The real investor makes his capital sweat on the right things. Any sort of capital – not only cash!

Think of capital as assets. Cash is an asset. People are an asset. Time is an asset.

An investor is a capital optimisation freak.

What does he optimise for? Profits. Returns.

An investor who is offered an investment opportunity always asks one question to himself first: “Is there anything else I can do instead to get more returns?”

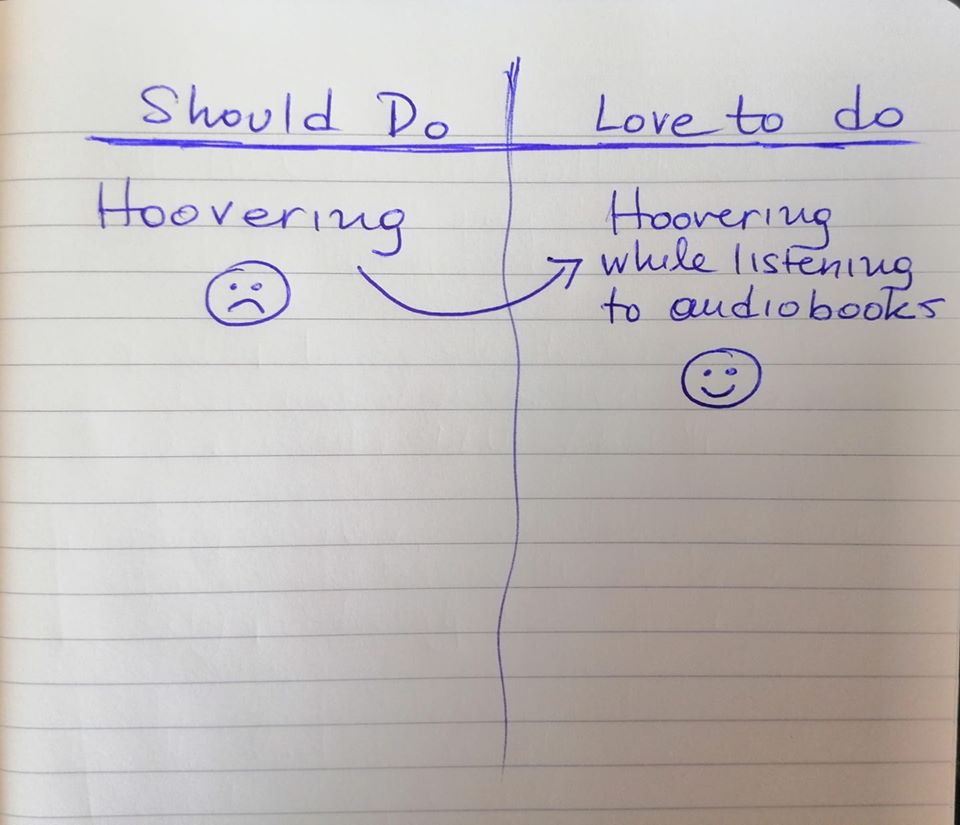

How do you want to be an investor if you’re not a master at how you allocate your own time?

Have you ever asked yourself the question: “Is this what I should be doing now?” If you don’t know how YOU should be spending your time, you’re probably not any better at allocating human capital, ie. other people’s time.

Do you want me to take it even further? You can optimise for things other than money. You can optimise for non-economic benefits such as health, love, or happiness.

Are your present actions optimal for future returns on economic and non-economic benefits?

This is how an investor thinks.

This is the real investor mentality in every aspect of life.

I’ll close this with some Buffett wisdom which shows how an investor thinks.

You can gain some insight into the differences between book value and intrinsic value by looking at one form of investment, a college education. Think of education’s cost as its “book value.” If this cost is to be accurate, it should include the earnings that were foregone by the student because he chose college rather than a job.

For this exercise, we will ignore the important non-economic benefits of an education and focus strictly on its economic value. First, we must estimate the earnings that the graduate will receive over his lifetime and subtract from that figure an estimate of what he would have earned had he lacked his education. That gives us an excess earnings figure, which must then be discounted, at an appropriate interest rate, back to graduation day. The dollar result equals the intrinsic economic value of the education.

Some graduates will find that the book value of their education exceeds its intrinsic value, which means that whoever paid for the education didn’t get his money’s worth. In other cases, the intrinsic value of an education will far exceed its book value, a result that proves capital was wisely deployed. In all cases, what is clear is that book value is meaningless as an indicator of intrinsic value.